Special Producer

Compensation Program

The Special Producer Compensation program (SPC) gives you the opportunity to increase your earning potential through two possible tracks. The Premier track focuses bonus payouts based on annualized new group business revenue and the Elite track rewards growth for a combination of in-force and annualized new business revenue. The track for each new year is determined by your prior year annualized in-force revenue calculated on December 31st.

Bonus Compensation Tracks

Premier track calculations based on:

- Annualized new group business revenue

- New lines of dental and vision

- Group fully-insured and ASO business

Elite track calculations based on:

- Annualized new group business revenue

- Annualized in-force revenue

- Revenue persistency from year to year

- Group fully-insured and ASO business

How the Premier track works

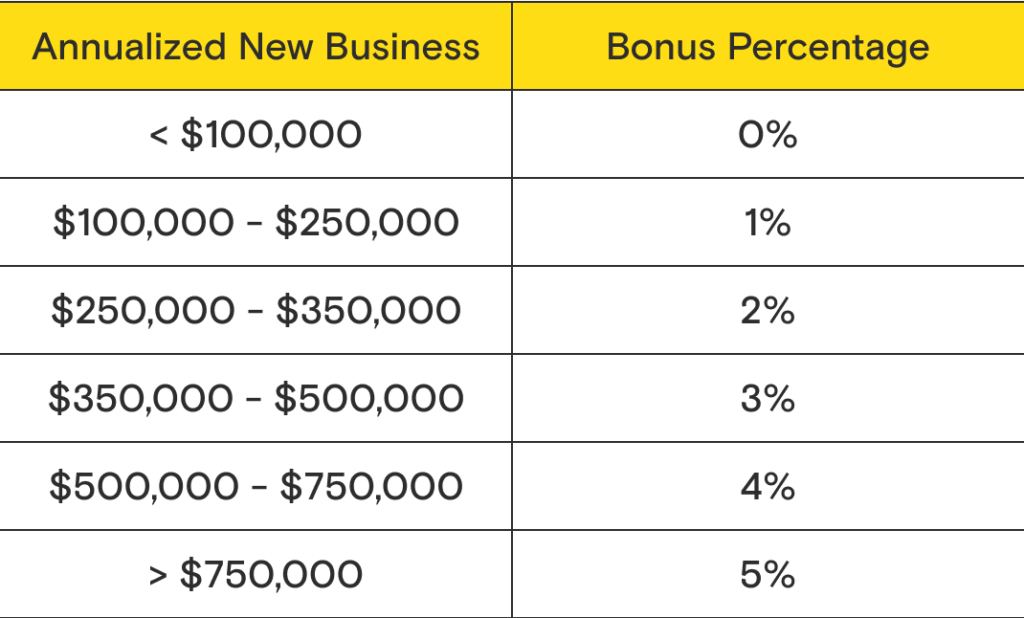

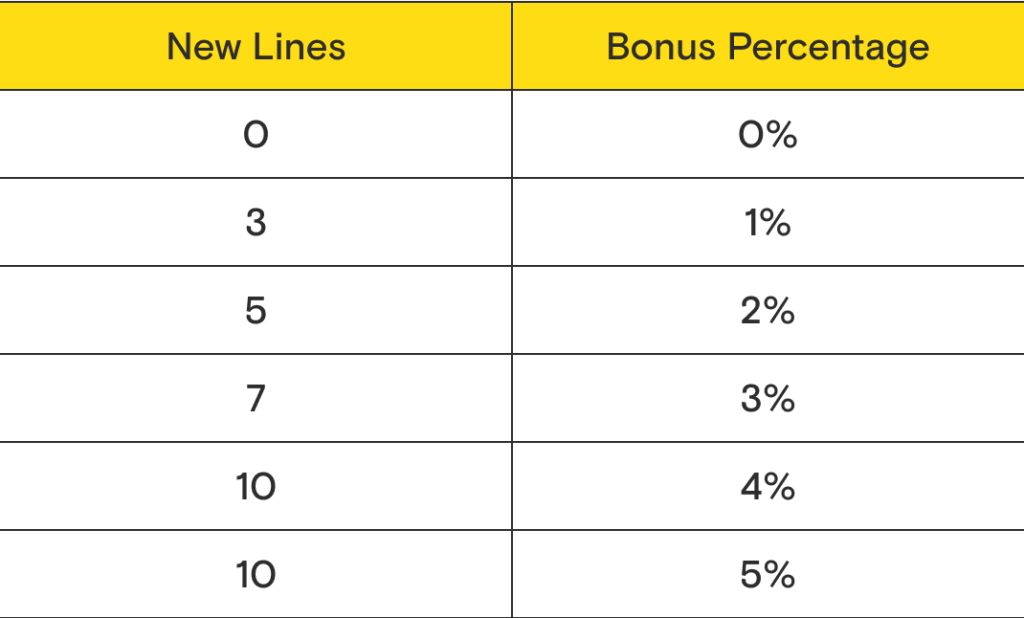

Your SPC bonus will be calculated based on your annualized new business revenue (capped at $1,000,000 per case) factored with the total new or added lines of business.

Premier track bonus calculation

- On December 31st of each year, new business revenue from fully-insured cases and ASO fees is annualized.

- Total new lines of business added to new or existing groups are calculated.

- Then, the lower of the new business bonus percentage and lines of business percentage determine the bonus payout percentage.

Example

Annualized new business revenue of $300,000 = 2%

4 lines of business (2 dental and 2 vision) = 1%

Total bonus percentage = 1%

= $3,000 Bonus payout

How the Elite track works

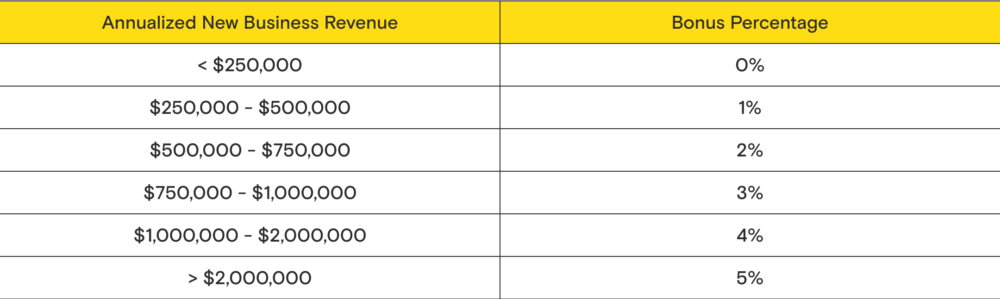

Your total SPC bonus is a combination of a new business bonus and an in-force bonus.

Elite Track Bonus Calculated as:

New Business Bonus + In-Force Bonus = Total SPC Bonus

New Business Bonus

- On December 31st of each year, new business revenue from fully-insured cases and ASO fees is annualized.

- Annualized revenue is then multiplied by the bonus percentage.

Example

$600,000 Annualized New Business x 2% Bonus Percentage

= $12,000 New Business Bonus Payout

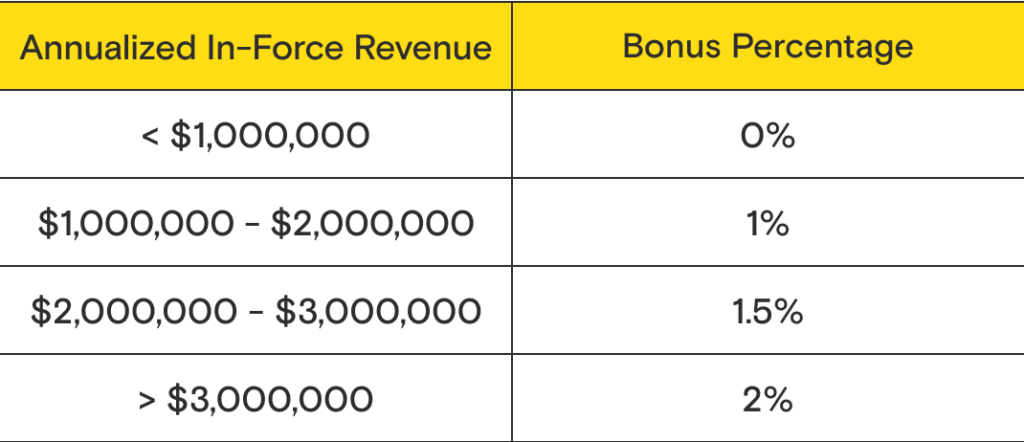

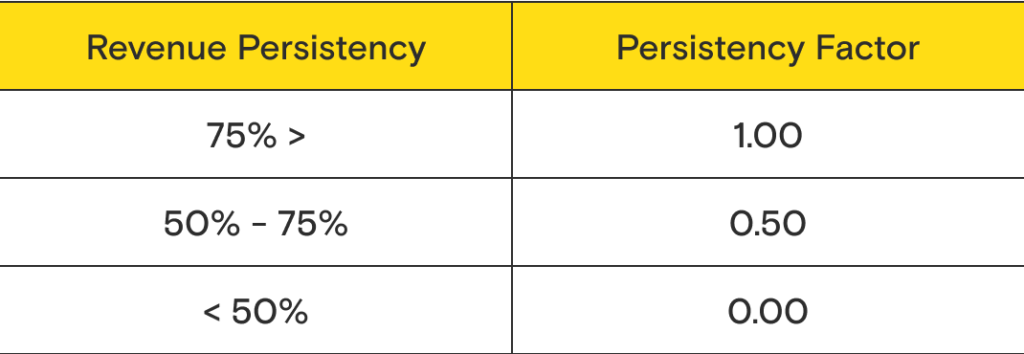

In-Force Bonus

- On December 31st of each year, qualifying in-force revenue from fully-insured cases and ASO fees is annualized, then multiplied by the bonus percentage.

- Revenue persistency calculation is the current annualized in-force revenue divided by the prior year annualized in-force revenue.

- Then, the current in-force revenue bonus is multiplied by the revenue persistency factor.

Example

$1,500,000 Annualized In-Force Revenue x 1% Bonus Percentage x 0.50 Revenue Persistency Factor

= $7,500 In-Force Bonus Payout

Example Elite Track Final Calculation

$12,000 New Business Bonus Payout + $7,500 In-Force Bonus Payout

= $19,500 Total SPC Bonus

Eligible Producers

Subject to the terms and conditions of the guidelines below, licensed and appointed producers who place new fully insured dental, vision and/or hearing plans and ASO fees are eligible for SPC.

SPC Rules

- To receive compensation for a contract, the producer must be the broker of record for the plan sold by the end of the same year.

- SPC is based on fully insured dental, vision and hearing annualized premium and ASO fees.

- Cases over $1 million in premium are individually negotiated for the new business bonus.

- Sales made through Ameritas business partners or those who convert to Ameritas business partners are not eligible.

- LASIK is a dental plan add-on and does not count as a line of coverage.

- Ameritas Edge Series, Trust products, Individual product sales premium, and BenefitEd are not included.

- Block acquisitions may not be included.

- In all matters relating to the interpretation or application of this bonus program, Ameritas’ decision is final. Ameritas reserves the right to cancel, amend or revoke the program at any time for any reason.

SPC Payment

- Compensation is based on the bonus program schedules.

- All compensation received will be included on your IRS 1099 form.

- Any overrides paid during the year will be subtracted from the in-force bonus.

- Compensation is paid to the licensed and appointed Ameritas producer who is the broker of record for the case.

- Plans sold by more than one producer are split among the producers based on the shared percentage of commission or as determined by Ameritas.

- For ASO cases, only the fees will be credited to the in-force annualized premium.

- New business is defined as the expected annual premium (and/or ASO fees) during the first 12 continuous months of the sold plan’s existence. New business is any line of business that:

- was newly effective with Ameritas/Dental Select during the current year, and

- remained continuously in-force with Ameritas/Dental Select until the last day of the calculation period.

- In-force business is defined as the expected total premium (and/or ASO fees) during the year that is NOT part of the first 12 months of the plan’s existence. In-force business is any line of business that:

- was in-force with Ameritas/Dental Select prior to the first day of the current year, and

- remained continuously in-force with Ameritas/Dental Select for at least the first month of the prior year.

- SPC runs January 1st to December 31st of each year.

- In-force business and new business bonuses are calculated once a year on December 31st.

- Bonuses are paid in April of the following year (consisting of the bonus amount earned for the entire year, less any SPC amount already paid for the current year and any override compensation).

- Revenue persistency is calculated by comparing the prior year’s business against the current year’s business. It is calculated once per year on December 31st.

- All cases must be received and approved before December 31st of the same year.

- SPC is paid on the current year’s annualized premium or fees on tailored cases that are in-force on the last day of the same year.